Dubai property market is seeing an upsurge of off-plan homes under AED 1 Million. Developers are trying to convince the renters to make a buy and turn themselves into homeowners by eliminating the tag of the tenant. But is it high time to invest in the best property in Dubai? The trend of increase in off-plan property purchasing is also pushed or updated with the Dubai RERA Rental Index enabling landlords to raise rents massively for the next lease. Whatever the reason behind the massive transformation of renters into homeowners, it is significant to focus on why this is happening, or whether it is projecting positive or negative implications on the Dubai property market.

Let’s dive into the insights of how massive numbers of tenants are becoming homeowners in Dubai with property prices less than AED 1 Million.

Rents in luxury and affordable segments maintained their increasing trend in the previous year of Q3 2023, with the Dubai population continuing to increase. The local economy is expanding in Dubai with more foreign businesses and several workers coming for work. This has also increased the demand for rental properties in the Dubai Real estate market.

Analysis done by property portal Bayut highlighted that affordable apartment rentals in renowned destinations or areas increased up to 11%. On the other hand, the cost of luxury apartment rentals increased by 13%.

It has also been evident in various scenarios making it an observable aspect, that the developers in Dubai are targeting renters with homes under AED 1 Million. This is being done to promote and encourage renters to become buyers. Although buying an apartment in Dubai is not convenient as of now, this is because the developers are tailoring payment plans specifically for the renters, resulting in ease and feasible payment plans.

Besides, the recent development in the Dubai RERA Rental Index allowed landlords to increase rents by up to 20%. Due to this, the renters are more interested in buying the property of Dubai under AED 1 million. For instance, Motor City and Town Square are priced at AED 770,000.

As the mortgages are high and the trend is also not showing any evidence of a decrease, it became difficult for the renters to buy property in Dubai amid high rents. However, the payment plans are not developed specifically to attract buyers.

Due to the appealing payment plans, a sale of off-plan grown is observed especially in the regions of Soba Hartland and Jumeirah Village Circle. If you want to buy apartments in Dubai now, it is more convenient as earlier, high rents pushed mid-income residents out of the line to purchase property in Dubai.

In 2023 the Dubai real-estate market performance was remarkable. A similar is expected this year as the Banks in the United Arab Emirates (UAE) are cutting down and reducing interest rates, making buying or becoming an owner of a house in Dubai more easy and accessible.

Although analysis showed that the United States Federal Reserve is yet to announce the rate cuts, UAR banks proactively took this decision in the anticipated decline of interest rates. This decline in interest rates has also boosted and converted the massive number of renters into Homeowners.

As highlighted earlier the developers in Dubai are targeting renters more, to attract them towards purchasing homes under AED 1 million. With the evolving landscape of Dubai, property developers are making home ownership easier by offering more properties that are feasible for buyers.

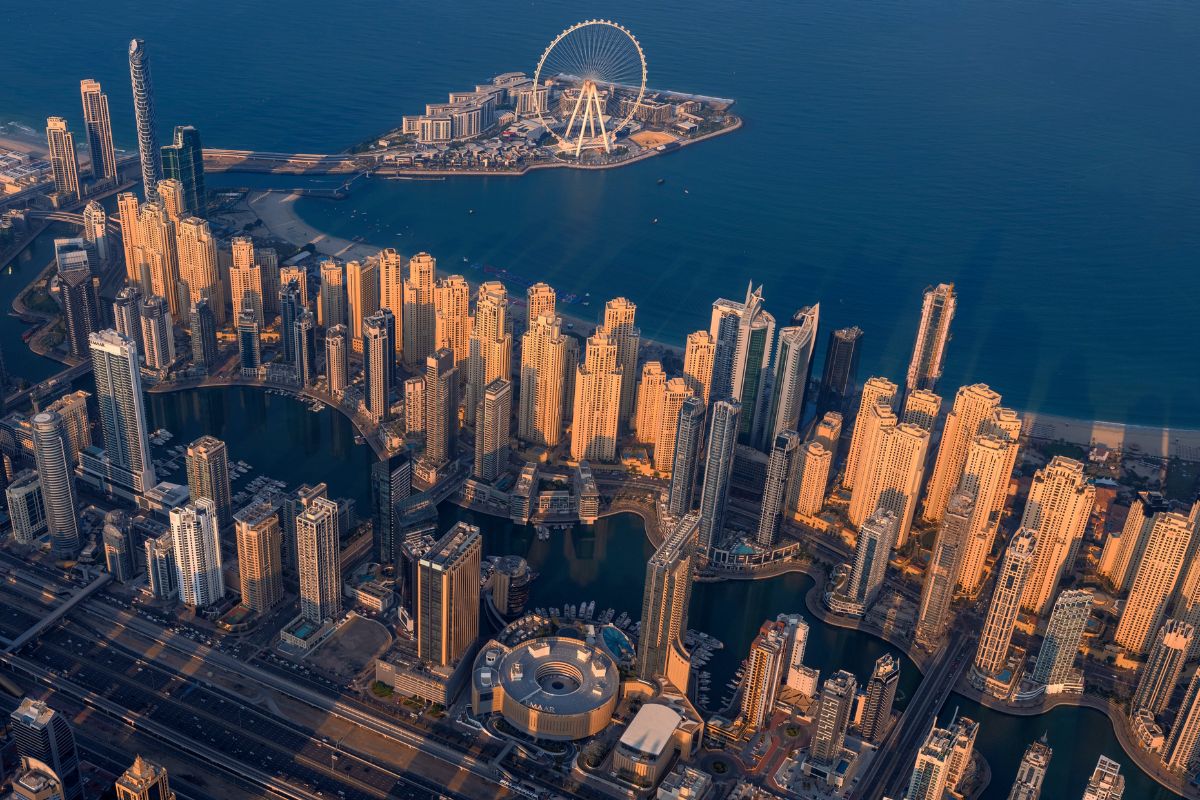

Some of the attractive properties for sale in Dubai for buyers include Jumeirah Village Triangle (JVT), Verona at Damac Hills 2, and Elitz 2 by Danube properties. In the luxury segment, residents who wanted to buy a property in Dubai focused on Dubai Silicon Oasis and Dubai Marina.

Dubai market is not showing any signs of slowing down in rentals, making it difficult for the tenants to renegotiate every time for the rent from a landlord. From the analysis above, it is evident that there are various aspects due to which renters are now more interested in owning homes under AED 1 Million. Reasons include reduced interest rates, easy payment plans, developers offering properties targeting mid-income buyers, and high rents. Therefore, it is high time to make the best property investment in Dubai, to avail yourself of benefits in the form of high ROI later.

Feel Free to Contact Us at Any Time, We Are Online 24/7