The Dubai real estate market report January 2026 shows a strong start to the year, backed by steady demand across villas, townhouses, and apartments. In January, Dubai recorded 14,923 total transactions with a combined sales value of AED 52.2 billion. The average sales price stood at AED 3.4 million, reflecting continued buyer confidence.

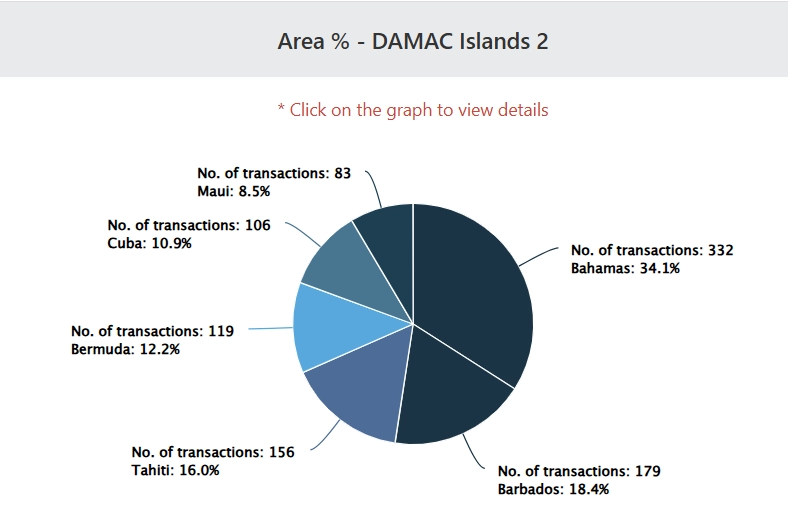

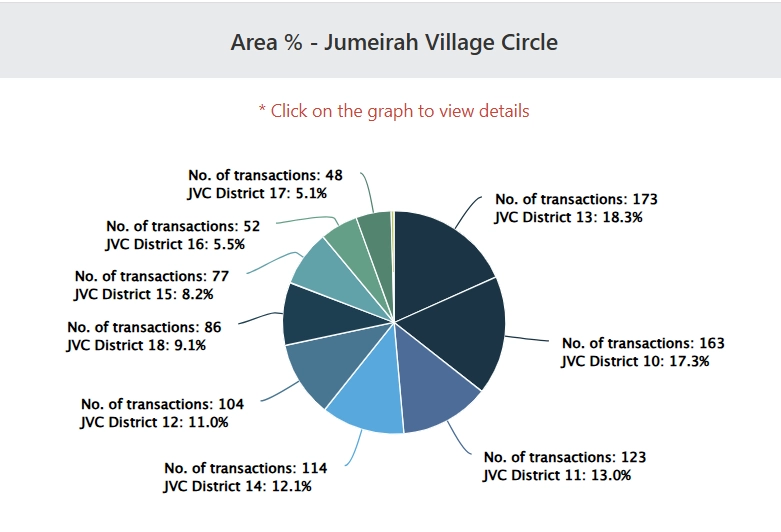

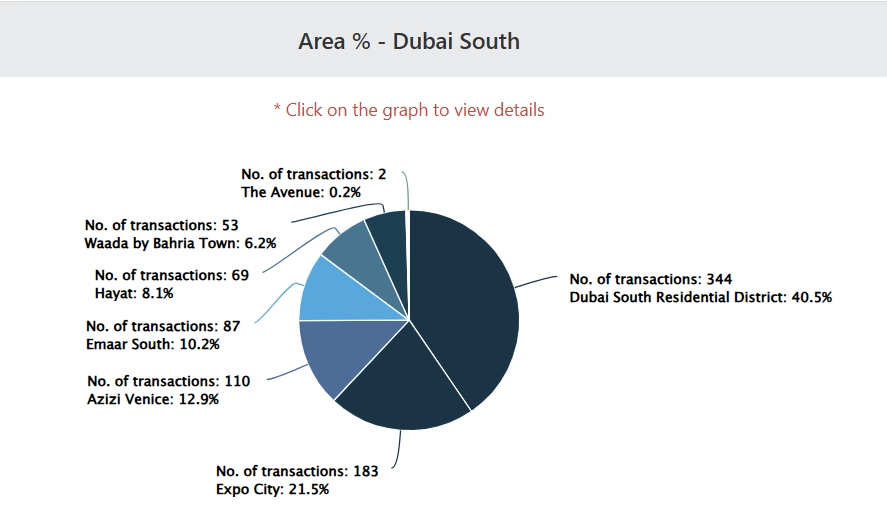

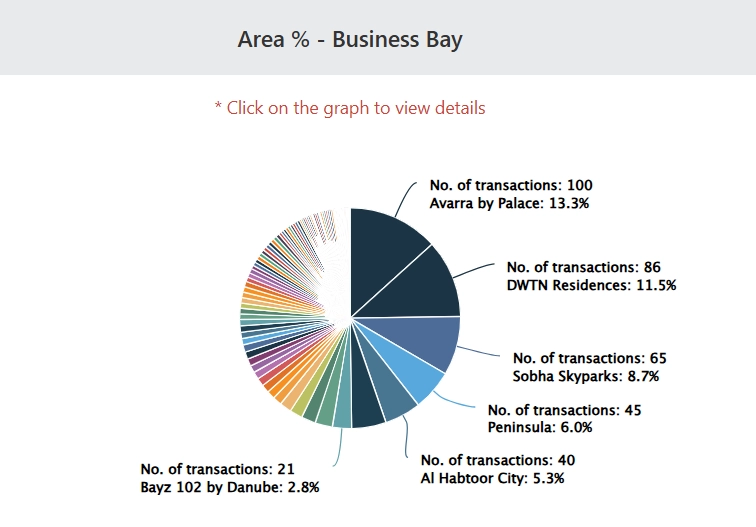

Damac Islands 2 ranked as the highest transacted area by sales value, driven mainly by townhouse deals. Other active locations included Jumeirah Village Circle, Dubai South, Business Bay, and Dubai Residence Complex, each catering to different buyer segments.

Villas and townhouses led value-driven deals, while apartments continued to dominate transaction volume, shaping the overall trend of Dubai real estate in January 2026.

Ultra-luxury villa resales crossed USD 3.15 billion, with cash buyers leading activity in completed homes.

DAMAC announced plans to issue USD benchmark senior unsecured notes, aimed at expanding its global investor base and improving liquidity.

Global real estate brands continue to enter the Middle East, with Dubai staying ahead due to investor-friendly ownership rules, tax benefits, and Golden Visa demand.

Dubai South added 653 new companies in 2025, pushing operational firms beyond 4,200 and supporting long-term housing demand.

Sobha Realty set aside AED 260 million in special bonuses after reporting AED 30 billion in FY2025 sales, supported by strong sukuk demand.

Dubai property market January 2026 saw some areas emerge as clear hotspots for property transactions. From apartments to villas, these communities recorded the highest sales activity. The following highlights show the key areas driving the market.

Damac Islands 2 emerged as the top-performing area in January, driven mainly by townhouse demand. Large family homes played a key role in pushing total sales value higher.

Total Sales Value per Bedroom

|

Bedroom Type |

Total Price (AED) |

No. of Transactions |

Average Price (AED) |

Avg. Price (AED/sq ft) |

|

4 Bed |

1,906,481,900 |

668 |

2,854,015 |

1,292 |

|

5 Bed |

1,387,043,825 |

307 |

4,518,058 |

1,349 |

Overall Property Performance

|

Property Type |

Volume |

Total Sales Price (AED) |

Avg. Sales Price (AED) |

Avg. Built-up Area (sq ft) |

Avg. Price (AED/sq ft) |

|

Townhouse |

950 |

3,205,820,745 |

3,374,548 |

2,562 |

1,309 |

|

Villa |

25 |

87,704,980 |

3,508,199 |

2,627 |

1,326 |

|

Overall |

975 |

3,293,525,725 |

3,377,975 |

2,563 |

1,310 |

Jumeirah Village Circle stayed active due to strong apartment demand. Affordable pricing and steady rental interest kept transaction volumes high.

Total Sales Value per Bedroom

|

Bedroom Type |

Total Price (AED) |

No. of Transactions |

Average Price (AED) |

Avg. Price (AED/sq ft) |

|

Studio |

173,847,650 |

255 |

681,755 |

1,629 |

|

1 Bed |

586,780,828 |

524 |

1,119,811 |

1,422 |

|

2 Bed |

203,541,188 |

121 |

1,682,159 |

1,294 |

|

3 Bed |

60,612,925 |

24 |

2,525,539 |

1,355 |

|

4 Bed |

40,810,000 |

11 |

3,710,000 |

1,164 |

Overall Property Performance

|

Property Type |

Volume |

Total Sales Price (AED) |

Avg. Sales Price (AED) |

Avg. Built-up Area (sq ft) |

Avg. Price (AED/sq ft) |

|

Apartment |

926 |

1,012,218,653 |

1,093,109 |

775 |

1,464 |

|

Townhouse |

12 |

41,930,000 |

3,494,167 |

3,365 |

1,081 |

|

Villa |

6 |

19,750,000 |

3,291,667 |

3,047 |

1,078 |

|

Overall |

944 |

1,073,898,653 |

1,137,605 |

822 |

1,457 |

Dubai South continued to gain attention due to infrastructure growth and business activity. Apartments led volumes, while townhouses showed higher average prices.

Total Sales Value per Bedroom

|

Bedroom Type |

Total Price (AED) |

No. of Transactions |

Average Price (AED) |

Avg. Price (AED/sq ft) |

|

Studio |

81,917,980 |

140 |

585,128 |

1,507 |

|

1 Bed |

322,315,910 |

261 |

1,234,927 |

1,608 |

|

2 Bed |

482,081,459 |

255 |

1,890,516 |

1,631 |

|

3 Bed |

234,016,478 |

84 |

2,785,910 |

1,343 |

|

4 Bed |

304,280,759 |

71 |

4,285,644 |

1,238 |

|

5 Bed |

210,335,000 |

36 |

5,842,639 |

1,208 |

|

6 Bed |

5,889,000 |

1 |

5,889,000 |

1,224 |

Overall Property Performance

|

Property Type |

Volume |

Total Sales Price (AED) |

Avg. Sales Price (AED) |

Avg. Built-up Area (sq ft) |

Avg. Price (AED/sq ft) |

|

Apartment |

695 |

988,475,116 |

1,422,266 |

891 |

1,588 |

|

Townhouse |

143 |

598,360,970 |

4,184,342 |

3,453 |

1,221 |

|

Villa |

12 |

85,624,397 |

7,135,366 |

5,001 |

1,411 |

|

Overall |

850 |

1,672,460,483 |

1,967,601 |

1,380 |

1,524 |

Business Bay remained a high-value apartment market. Central location and waterfront access kept average prices among the highest in January.

Total Sales Value per Bedroom (01 Jan 2026 – 31 Jan 2026)

|

Bedroom Type |

Total Price (AED) |

No. of Transactions |

Average Price (AED) |

Avg. Price (AED/sq ft) |

|

Studio |

115,190,911 |

100 |

1,151,909 |

2,470 |

|

1 Bed |

921,247,790 |

384 |

2,399,083 |

2,873 |

|

2 Bed |

789,954,022 |

204 |

3,872,324 |

2,726 |

|

3 Bed |

418,591,891 |

53 |

7,897,960 |

3,163 |

|

4 Bed |

122,754,814 |

10 |

12,275,481 |

2,842 |

Overall Property Performance

|

Property Type |

Volume |

Total Sales Price (AED) |

Avg. Sales Price (AED) |

Avg. Built-up Area (sq ft) |

Avg. Price (AED/sq ft) |

|

Apartment |

751 |

2,367,739,428 |

3,152,782 |

1,090 |

2,799 |

|

Overall |

751 |

2,367,739,428 |

3,152,782 |

1,090 |

2,799 |

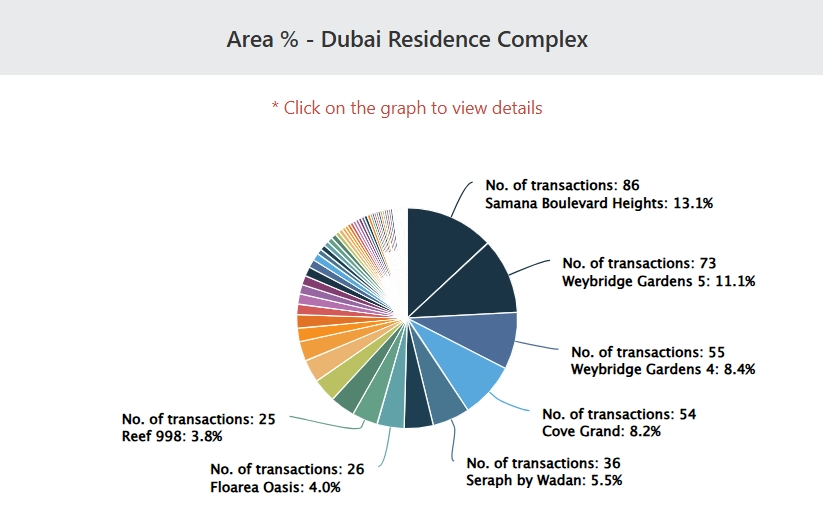

Dubai Residence Complex stayed active due to lower entry prices. Studio and one-bedroom units dominated overall sales.

Total Sales Value per Bedroom

|

Bedroom Type |

Total Price (AED) |

No. of Transactions |

Average Price (AED) |

Avg. Price (AED/sq ft) |

|

Studio |

203,297,873 |

300 |

677,660 |

1,548 |

|

1 Bed |

251,788,481 |

252 |

999,161 |

1,235 |

|

2 Bed |

122,096,275 |

90 |

1,356,625 |

1,124 |

|

3 Bed |

26,086,836 |

15 |

1,739,122 |

1,172 |

|

4 Bed |

2,366,286 |

1 |

2,366,286 |

1,427 |

Overall Property Performance

|

Property Type |

Volume |

Total Sales Price (AED) |

Avg. Sales Price (AED) |

Avg. Built-up Area (sq ft) |

Avg. Price (AED/sq ft) |

|

Apartment |

658 |

605,635,751 |

920,419 |

716 |

1,361 |

|

Overall |

658 |

605,635,751 |

920,419 |

716 |

1,361 |

The Dubai real estate market report January 2026 closed the month on a strong note with 14,923 property transactions worth AED 52.2 billion. The average property price reached AED 3.4 million, showing stable buyer confidence across segments. Damac Islands 2 led the market by total sales value, while Jumeirah Village Circle, Dubai South, Business Bay, and Dubai Residence Complex stayed active due to steady demand. Townhouses and villas drove value, while apartments supported volume, defining the overall direction of the Dubai real estate market in January 2026.

If you are planning to invest in Dubai real estate, contact Primo Capital today. We can guide you with clear details on area performance, pricing, unit types, and upcoming handovers. Let’s start your property journey now.

Feel Free to Contact Us at Any Time, We Are Online 24/7