The Dubai real estate report 2025 shows a dynamic year for the property market. According to official data, total property sales in 2025 have already surpassed AED541.5 billion, exceeding the full‑year sales of AED522.1 billion in 2024. Jumeirah Village Circle emerged as the top area, recording 17,915 transactions, making it the most active community for buyers and investors alike. Residential properties dominated the market, while commercial transactions also saw notable growth, reaching AED2.3 billion in deals.

International buyers continued to play a key role in Dubai’s property scene. Investors from India, the UK, and China were among the top contributors, bringing diversity and confidence to the market. Overall, the Dubai real estate in 2025 highlights a balanced market where both residential and commercial sectors contributed to a year of significant growth.

Properties for sale in Dubai continued its strong performance in 2025, building on record momentum from the previous year. The market saw significant growth in both value and volume, with activities spread across residential, commercial, off‑plan and resale sectors.

Key Highlights:

Our Dubai real estate market report 2025 recorded strong performance across both residential and commercial segments. During the year, residential properties generated AED541.5 billion in total sales value, while commercial real estate recorded approximately AED 15.5 billion in sales, reflecting sustained buyer confidence across multiple asset classes.

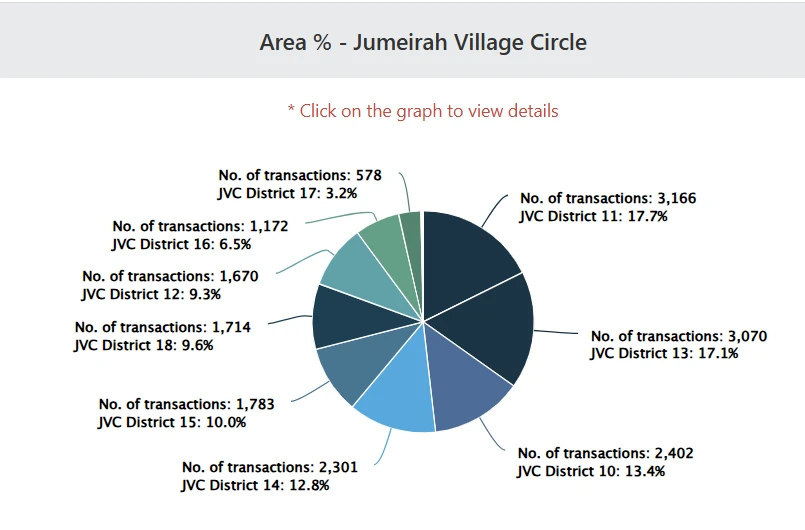

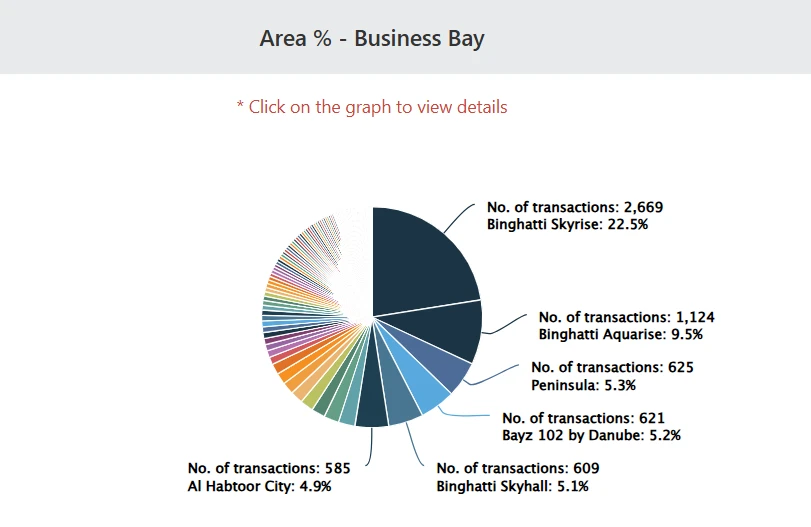

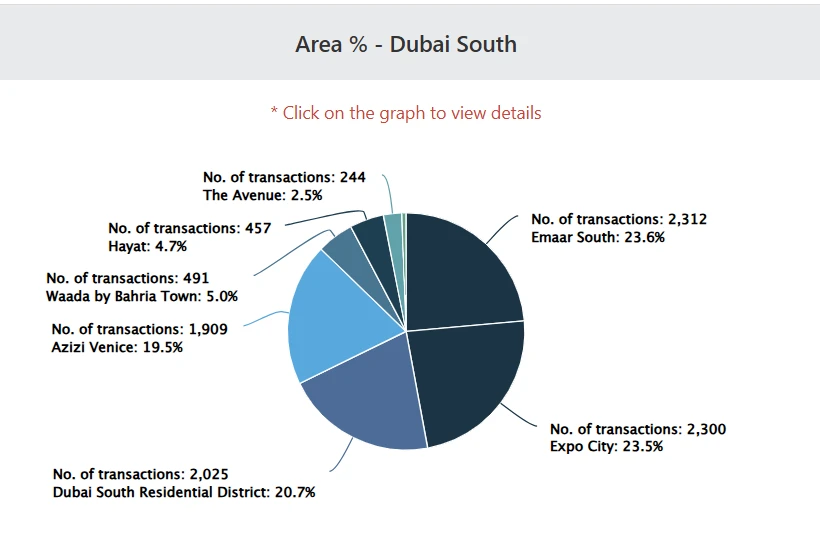

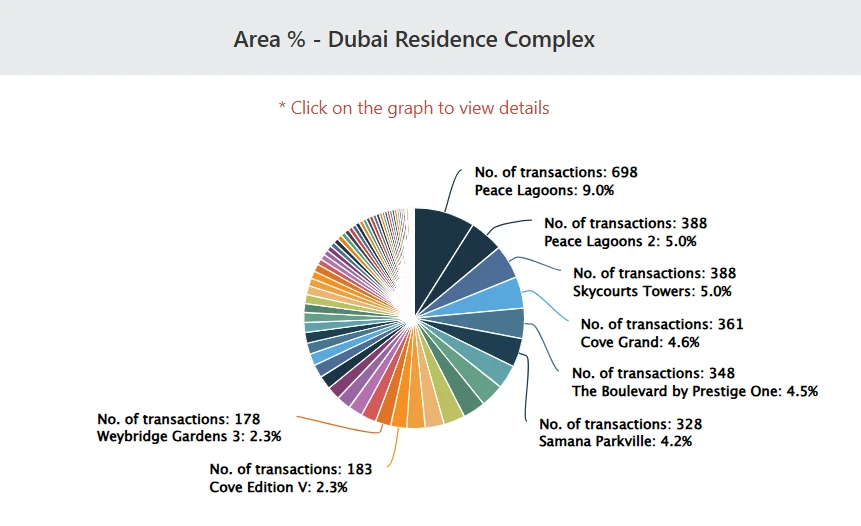

In Dubai real estate market 2025, certain communities in Dubai attracted the highest buyer activity. Areas like Jumeirah Village Circle, Business Bay, Dubai South, and Dubai Residence Complex recorded significant sales and transaction volumes.

Properties for sale in Jumeirah Village Circle led the market in 2025, with high transaction volumes driven mainly by apartments.

Property Type Breakdown

|

Property Type |

Volume |

Total Sales Price (AED) |

Average Sales Price (AED) |

Average Built-up Area (sq ft) |

Average Price per sq ft (AED) |

|

Apartment |

17,544 |

18,517,880,622 |

1,055,511 |

760 |

1,462 |

|

Townhouse |

314 |

998,953,900 |

3,181,382 |

3,150 |

1,013 |

|

Villa |

57 |

240,251,658 |

4,214,941 |

3,144 |

1,373 |

Apartments for sale in Business Bay continued to attract investors. The area recorded strong high-value deals.

Property Type Breakdown

|

Property Type |

Volume |

Total Sales Price (AED) |

Average Sales Price (AED) |

Average Built-up Area (sq ft) |

Average Price per sq ft (AED) |

|

Apartment |

11,868 |

27,779,731,948 |

2,340,726 |

929 |

2,468 |

|

Villa |

1 |

3,950,000 |

3,950,000 |

2,631 |

1,501 |

Dubai South properties for sale showed steady growth in 2025, with both townhouses and apartments driving activity. Villas for sale in Dubai South contributed fewer but higher-value transactions.

Property Type Breakdown

|

Property Type |

Volume |

Total Sales Price (AED) |

Average Sales Price (AED) |

Average Built-up Area (sq ft) |

Average Price per sq ft (AED) |

|

Apartment |

7,663 |

11,117,488,528 |

1,450,801 |

867 |

1,660 |

|

Townhouse |

1,912 |

7,305,504,262 |

3,820,870 |

3,003 |

1,297 |

|

Villa |

220 |

2,009,961,270 |

9,136,188 |

6,742 |

1,353 |

Dubai Residence Complex remained focused on apartment sales, with townhouses and villas representing a small fraction of deals.

Property Type Breakdown

|

Property Type |

Volume |

Total Sales Price (AED) |

Average Sales Price (AED) |

Average Built-up Area (sq ft) |

Average Price per sq ft (AED) |

|

Apartment |

7,788 |

6,752,096,729 |

866,987 |

701 |

1,326 |

|

Villa |

2 |

1,223,519 |

611,760 |

454 |

1,348 |

|

Townhouse |

2 |

1,641,584 |

820,792 |

834 |

1,089 |

In this Dubai real estate Market report 2025 we have listed the top real estate developers who have contributed throughout the year. These top real estate developers in Dubai 2025 delivered high-quality residential, commercial, and mixed-use projects that attracted local and international buyers.

Emaar Properties is known for luxury projects and large-scale communities. Its portfolio includes some of Dubai’s most iconic developments.

Key Projects:

Aldar Properties expanded into Dubai, offering residential, retail, and mixed-use developments. Its projects appeal to investors seeking premium options.

Key Projects:

Nakheel Properties is known for large-scale waterfront developments. It has transformed Dubai’s coastline with man-made islands.

Key Projects:

Damac Properties focuses on luxury residences and lifestyle communities. Its developments combine branded residences with family-friendly amenities.

Key Projects:

Meraas develops lifestyle-driven urban projects integrating residential, retail, and leisure spaces.

Key Projects:

As per our Dubai real estate report 2025 , Dubai’s luxury property market continued to break records with high‑value sales across the city’s most coveted addresses. Among the top deals were The Marble Palace in Emirates Hills, a plot in Palm Jumeirah, and island communities that set new benchmarks for the year.

1. The Marble Palace, Emirates Hills (Sold for AED 425 Million)

The Marble Palace in Emirates Hills became one of the most expensive residential sales in 2025. Located in Dubai’s most prestigious gated community, the property spans more than 70,000 sq ft of land with grand architectural design and premium finishes.

2. Palm Jumeirah Plot (Sold for AED 365 Million)

One of the highest‑value land deals on Palm Jumeirah in 2025 involved a prime seafront plot. This rare piece of land offers expansive views, direct beach access, and opportunities for ultra‑luxury development.

3. Jumeirah Bay Villa (Sold for AED 330 Million)

A standout residential sale on Jumeirah Bay Island closed at AED 330 million, marking it as one of the most expensive villas of the year. The villa commands panoramic water and skyline views and delivers luxurious indoor‑outdoor living.

4. Beachfront Villa, Palm Jumeirah (Sold for AED 300 Million)

This beachfront villa on Palm Jumeirah’s most exclusive frond ranked among the top residential property sales of 2025. Its design blends modern architecture with resort‑style living and sweeping sea views.

5. Bulgari Lighthouse Penthouse, Jumeirah Bay Island (Sold for AED 282 Million)

At Jumeirah Bay Island, a luxury branded residence in the Bulgari Lighthouse has become one of the region’s most expensive penthouse deals. Its Italian design and high‑end services set it apart.

Foreign investors continued to dominate Dubai’s real estate market in 2025, accounting for over 40% of total residential ownership. Buyers from India, the UK, China, Saudi Arabia, and Russia led the way, bringing strong demand across luxury villas, apartments, and off-plan developments.

Indian investors remained the largest foreign buyer group, representing around 22% of the market in 2025. Cultural ties, proximity, and the UAE’s tax-friendly policies make Dubai a preferred choice.

British investors contributed approximately 17% of foreign purchases. They are drawn to Dubai’s luxury lifestyle, waterfront properties, and attractive rental yields.

Saudi nationals represented around 11% of foreign buyers in 2025, focusing on luxury developments and prime locations. Their investments combine lifestyle preferences with portfolio diversification.

Russian investors accounted for roughly 9% of foreign property buyers, increasingly viewing Dubai as a safe haven for capital. They favor high-end apartments and villas in established luxury communities.

Chinese buyers made up around 14% of foreign investors in 2025, driven by growing economic collaboration and long-term residency incentives.

As per our real estate report for Dubai 2025, apartments continued to drive market volume, while villas led in total sales value due to higher ticket sizes. Townhouses held steady demand from end-users and families.

Apartments for sale in Dubai made up the largest share of transactions due to strong demand in 2025. Villas recorded the highest average prices and price per sq ft, and townhouses remained a middle-ground option with balanced pricing and space.

|

Property Type |

Total Transactions |

Total Sales Value (AED) |

Total Built-up Area (sq ft) |

Avg. Sale Price (AED) |

Avg. Built-up Area (sq ft) |

Avg. Plot Size (sq ft) |

Avg. Price (AED/sq ft) |

|

Overall |

200,447 |

540,656,630,250 |

267,983,811 |

2,697,255 |

1,349 |

3,856 |

1,856 |

|

Apartment |

165,983 |

323,347,800,885 |

154,962,756 |

1,948,078 |

934 |

– |

1,921 |

|

Townhouse |

23,094 |

75,099,558,146 |

56,859,818 |

3,251,908 |

2,515 |

2,201 |

1,283 |

|

Villa |

11,370 |

142,209,271,219 |

56,161,237 |

12,507,412 |

5,609 |

7,207 |

2,058 |

1-2 BR units led to total value due to a mix of volume and pricing. Larger homes recorded fewer deals but higher average prices, showing steady demand in the luxury segment.

|

Unit Type |

Total Sales Value (AED) |

Transactions |

Avg. Price (AED) |

Avg. Price (AED/sq ft) |

|

Studio |

32,510,402,518 |

41,665 |

780,281 |

1,828 |

|

1 Bed |

107,351,455,730 |

74,141 |

1,447,936 |

1,829 |

|

2 Bed |

110,033,894,014 |

41,059 |

2,679,897 |

1,992 |

|

3 Bed |

83,423,676,480 |

18,365 |

4,542,536 |

1,949 |

|

4 Bed |

92,541,528,255 |

16,588 |

5,578,824 |

1,575 |

|

5 Bed |

60,975,568,758 |

5,664 |

10,765,461 |

1,784 |

|

6 Bed |

28,267,551,830 |

1,394 |

20,278,014 |

2,361 |

|

7 Bed |

6,674,415,703 |

233 |

28,645,561 |

2,156 |

|

8 Bed |

380,499,980 |

16 |

23,781,249 |

3,432 |

|

9 Bed |

27,555,000 |

5 |

5,511,000 |

– |

|

10 Bed |

116,629,000 |

7 |

16,661,286 |

661 |

In 2025, buyer interest in Dubai shifted toward locations that combine location strength, rental demand, and steady price growth. These emerging areas stood out due to consistent transactions, strong occupancy, and clear end-user appeal.

Properties for sale in Business Bay continued to strengthen its position as a high-activity zone for both homes and offices. Residential activity remained driven by professionals and short-term tenants. New project launches in 2025 added supply without slowing absorption.

Dubai Hills Estate properties for sale gained momentum as more buyers moved toward larger homes outside dense city zones. Sales in villas and townhouses remained active due to limited supply and consistent end-user demand. Apartments also performed well near retail and park-facing zones.

JVC remained one of the most active emerging areas by transaction count in 2025. Smaller unit sizes and growing community facilities helped maintain strong occupancy. Investors focused on projects with efficient layouts and near retail clusters.

Downtown Dubai retained its appeal as a low-risk, high-liquidity zone. Luxury apartments for sale in Downtown Dubai continued to attract long-term investors who value price stability over rapid short-term gains. Short-term rentals remained a major driver of yields.

Properties for sale in Dubai Creek Harbour emerged as a preferred waterfront choice in 2025. Its location between Downtown and the airport supported both rental and end-user demand. Creek-facing units recorded better absorption and pricing.

The Dubai Real Estate Market Report 2025 reflects a year of strong and balanced growth across the property sector. With over 200,780 total transactions, residential sales reached AED 541.5 billion, while commercial properties added approximately AED 15.5 billion in value.

Areas such as Jumeirah Village Circle, Business Bay, Downtown Dubai, and Dubai Hills Estate led market activity, supported by steady demand across apartments, villas, and townhouses. 1- and 2-bedroom units dominated transaction volumes, while luxury homes set new pricing benchmarks. Overall, 2025 closed as a confident year for Dubai real estate, backed by global investor trust and consistent market momentum.

If you are planning to invest in Dubai real estate, contact Primo Capital today. We can guide you with clear details on area performance, pricing, unit types, and upcoming handovers. Let’s start your property journey now.

Feel Free to Contact Us at Any Time, We Are Online 24/7