The Dubai property market report August 2025 highlights another record-breaking month for property transactions. The market touched nearly AED 51.49 billion in total sales. Apartments remained the strongest segment, recording a 29.2% growth compared to August 2024, with more than 15,900 transactions worth AED 30.2 billion. These figures reflect the varied performance of the Dubai property market in 2025, where apartments led the growth momentum while villas slowed down.

|

Developer |

Total Value (AED) |

Volume |

|

Emaar |

AED 51.7B |

9,753 |

|

Damac Properties |

AED 24.8B |

9,934 |

|

Sobha Group |

AED 13.9B |

5,991 |

|

Nakheel |

AED 12.6B |

1,443 |

|

Meraas |

AED 10.7B |

1,262 |

|

Binghatti |

AED 10.6B |

7,381 |

|

Aldar |

AED 8.6B |

1,710 |

|

Omniyat |

AED 7.7B |

1,597 |

|

H&H Development |

AED 6.2B |

475 |

|

Danube Properties |

AED 4.3B |

2,650 |

Emaar stands as Dubai’s largest and most iconic real estate developer—behind landmarks like the Burj Khalifa and Dubai Mall. In the first half of 2025 alone, it posted a 46% surge in property sales, reaching approximately AED 46 billion, while its revenue backlog shot up 62% to AED 146.3 billion. Net profit also climbed 33%, hitting AED 7.08 billion, showing strong demand and robust financial performance.

Founded in 2002, Damac Properties has become one of the UAE’s most prominent luxury real estate developers, known for high-end residential, commercial, and leisure projects. The company has delivered over 45,000 homes and has more than 30,000 units in planning and development. Damac is widely recognized for branded collaborations with global names like Cavalli, de GRISOGONO, and Versace, shaping some of Dubai’s most stylish addresses.

Sobha Realty continues to strengthen its position across the UAE, expanding beyond Dubai into Abu Dhabi and Umm Al Quwain. As of mid-2025, it had completed 63 projects, recorded AED 16.47 billion in sales, and executed 6,649 transactions, ranking among the top private developers in terms of performance.

Nakheel is widely known for master-planned communities like Palm Jumeirah, Jumeirah Village Circle, and Dubai Islands. Serving as a strategic master developer, it has delivered over 45,000 residential units, built more than 21 million square feet of commercial space, and maintains a pipeline of over 21,000 additional units.

Meraas Properties continues shaping Dubai's appeal through vibrant lifestyle destinations, including Bluewaters, City Walk, and La Mer. While specific 2025 sales figures are unavailable in authoritative sources, the developer is known for these iconic, experience-led projects that define modern urban living.

Binghatti has made a mark through bold branded residential towers, including Bugatti Residences, Jacob & Co Residences, and Mercedes-Benz Places. In August 2025, it launched a USD 500 million sukuk, which drew strong investor interest, with subscriptions reaching USD 2.5 billion.

While Aldar is a major player—especially in Abu Dhabi’s real estate sector—specific figures for early 2025 weren’t detailed in publicly available authoritative sources. However, the developer continues to deliver large-scale, mixed-use projects that contribute significantly to the region's landscape.

Omniyat earns recognition for luxury properties across Dubai, but reliable data or confirmed statistics for early 2025 from top-tier sources isn’t available at this time.

H&H Development is acknowledged as an active Dubai developer, but authoritative and updated information for early 2025 is not publicly available in respected sources.

Danube Properties focuses on accessible luxury in Dubai’s mid-income segments. In 2025, it unveiled two major projects: Diamondz (valued at AED 2.4 billion) in JLT, and Sparklz, which debuted at IPS 2025. The company also became known for its popular 1% payment plan, helping make homeownership more attainable.

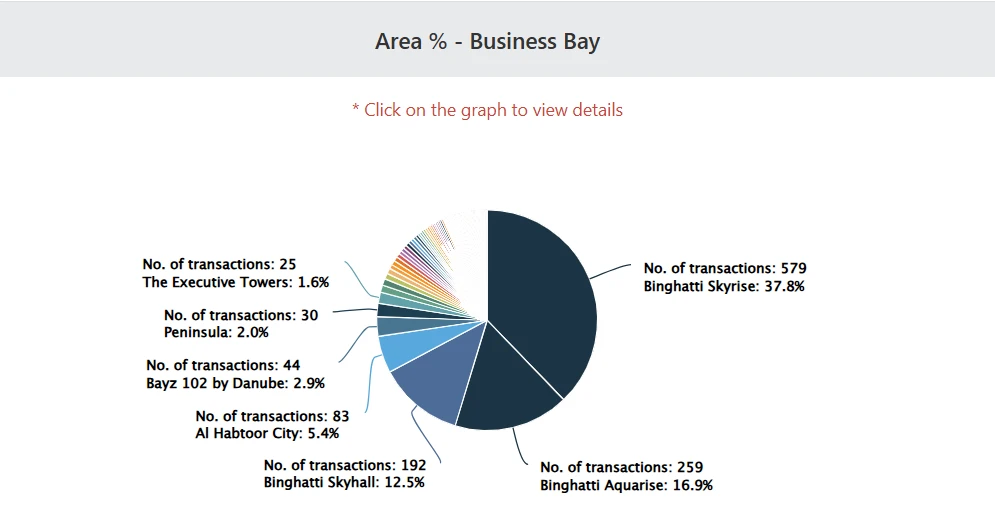

Business Bay continued to attract buyers with strong activity in studios and one-bedroom apartments.

Sales by Bedroom (Aug 2025)

|

Type |

Total Price (AED) |

No. of Transactions |

Average Price (AED) |

Avg Price (AED/sq ft) |

|

Studio |

1,052,539,508 |

845 |

1,245,609 |

2,786 |

|

1 Bed |

1,071,719,584 |

484 |

2,214,297 |

2,524 |

|

2 Bed |

435,514,187 |

140 |

3,110,816 |

2,190 |

|

3 Bed |

313,766,596 |

51 |

6,152,286 |

2,415 |

|

4 Bed |

151,343,157 |

9 |

16,815,906 |

3,426 |

|

6 Bed |

55,600,181 |

3 |

18,533,394 |

2,680 |

Property Type Sales

|

Category |

Transactions |

Sales Value (AED) |

Avg Price (AED) |

Avg Size (sq ft) |

Avg Price/sq ft |

|

Apartment |

1,532 |

3,080,483,213 |

1,182,697 |

2,010,759 |

2,640 |

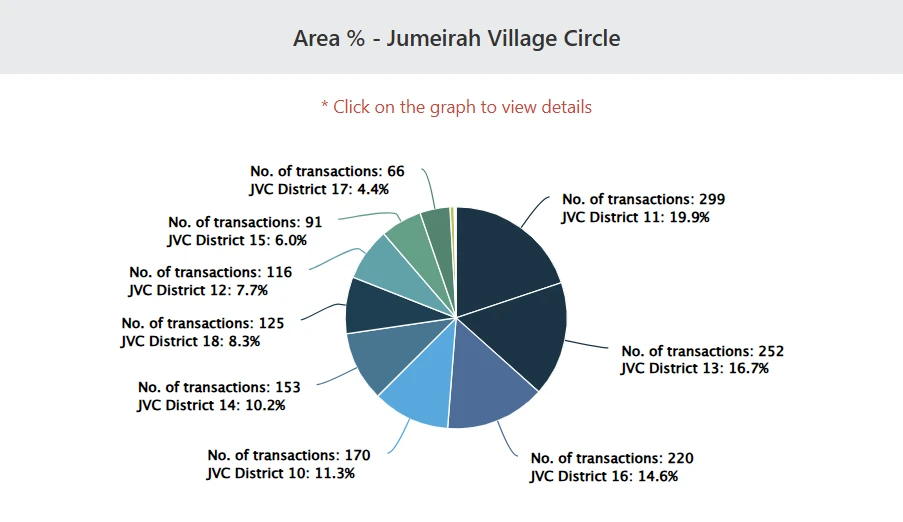

JVC showed strong demand for one-bedroom units, supported by affordable prices per sq ft.

Sales by Bedroom (Aug 2025)

|

Type |

Total Price (AED) |

No. of Transactions |

Average Price (AED) |

Avg Price (AED/sq ft) |

|

Studio |

350,242,324 |

492 |

711,875 |

1,681 |

|

1 Bed |

918,447,916 |

786 |

1,168,509 |

1,460 |

|

2 Bed |

320,382,303 |

183 |

1,750,723 |

1,301 |

|

3 Bed |

68,458,901 |

28 |

2,444,961 |

1,153 |

|

4 Bed |

40,448,326 |

12 |

3,370,694 |

1,044 |

|

5 Bed |

3,080,000 |

1 |

3,080,000 |

855 |

Property Type Sales

|

Category |

Transactions |

Sales Value (AED) |

Avg Price (AED) |

Avg Size (sq ft) |

Avg Price/sq ft |

|

Apartment |

1,475 |

1,610,275,264 |

1,118,187 |

1,091,712 |

1,512 |

|

Townhouse |

27 |

84,454,506 |

3,127,945 |

3,204 |

1,009 |

|

Villa |

3 |

11,450,000 |

3,816,667 |

6,047 |

1,344 |

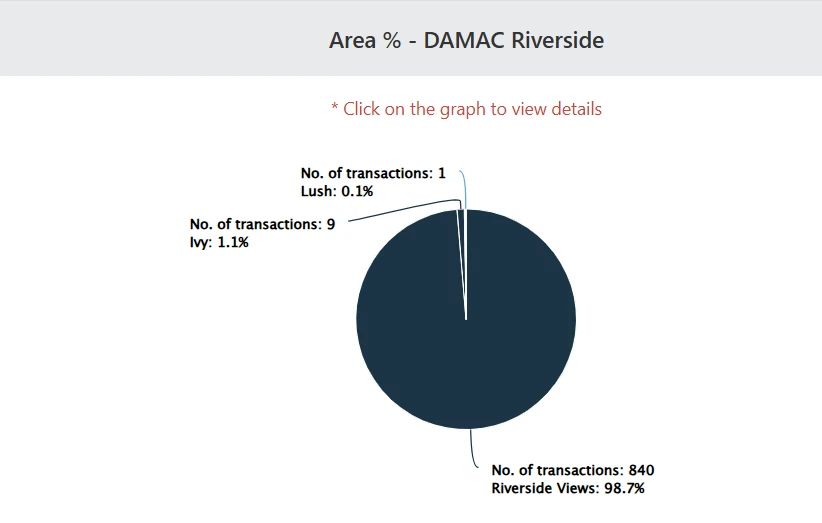

Damac Riverside showed healthy movement, mainly in one-bedroom apartments.

Sales by Bedroom (Aug 2025)

|

Type |

Total Price (AED) |

No. of Transactions |

Average Price (AED) |

Avg Price (AED/sq ft) |

|

1 Bed |

813,535,109 |

707 |

1,150,686 |

1,478 |

|

2 Bed |

245,008,842 |

133 |

1,842,172 |

1,477 |

|

4 Bed |

13,815,000 |

5 |

2,763,000 |

1,164 |

|

5 Bed |

24,411,000 |

6 |

4,068,500 |

1,189 |

Property Type Sales

|

Category |

Transactions |

Sales Value (AED) |

Avg Price (AED) |

Avg Size (sq ft) |

Avg Price/sq ft |

|

Apartment |

840 |

1,058,543,951 |

1,260,171 |

854 |

1,477 |

|

Townhouse |

11 |

38,226,000 |

3,475,091 |

2,168 |

1,178 |

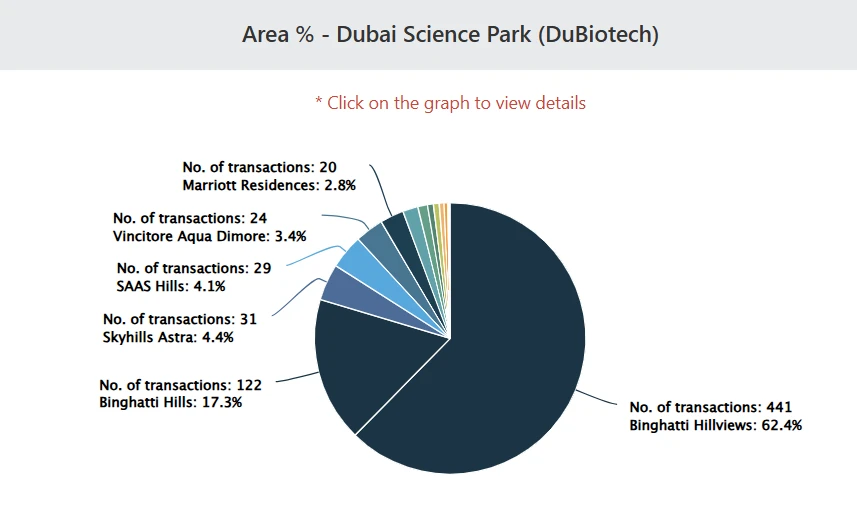

Dubai Science Park maintained demand for studios and one-bedroom apartments.

Sales by Bedroom (Aug 2025)

|

Type |

Total Price (AED) |

No. of Transactions |

Average Price (AED) |

Avg Price (AED/sq ft) |

|

Studio |

244,204,886 |

273 |

894,523 |

1,952 |

|

1 Bed |

442,815,102 |

342 |

1,294,781 |

1,517 |

|

2 Bed |

211,313,681 |

86 |

2,457,136 |

1,544 |

|

3 Bed |

15,760,962 |

5 |

3,152,192 |

1,344 |

|

4 Bed |

7,849,318 |

1 |

7,849,318 |

2,016 |

Property Type Sales

|

Category |

Transactions |

Sales Value (AED) |

Avg Price (AED) |

Avg Size (sq ft) |

Avg Price/sq ft |

|

Apartment |

707 |

921,943,949 |

1,304,023 |

813 |

1,687 |

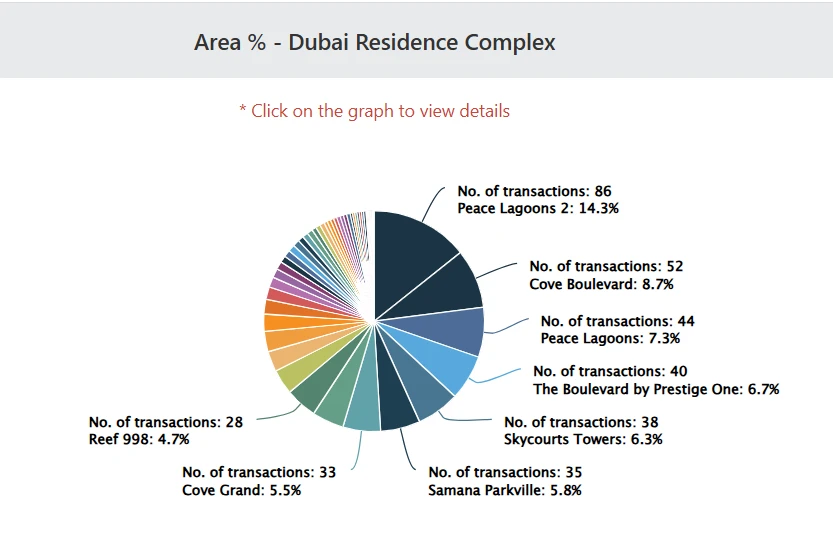

Dubai Residence Complex gained traction due to its affordability and compact apartments.

Sales by Bedroom (Aug 2025)

|

Type |

Total Price (AED) |

No. of Transactions |

Average Price (AED) |

Avg Price (AED/sq ft) |

|

Studio |

211,049,471 |

312 |

676,441 |

1,580 |

|

1 Bed |

213,963,394 |

218 |

981,483 |

1,232 |

|

2 Bed |

81,227,495 |

63 |

1,289,325 |

1,007 |

|

3 Bed |

13,568,359 |

8 |

1,696,045 |

1,045 |

Property Type Sales

|

Category |

Transactions |

Sales Value (AED) |

Avg Price (AED) |

Avg Size (sq ft) |

Avg Price/sq ft |

|

Apartment |

601 |

519,808,719 |

864,906 |

671 |

1,387 |

The Dubai property market report August 2025 reflects steady growth with apartments and commercial properties leading the way, while villa sales slowed down. Rental values continued their upward trend, showing strong demand across all segments. With top developers posting multi-billion-dirham sales and prime areas recording high transactions, the Dubai real estate market remains one of the strongest in the region.

Feel Free to Contact Us at Any Time, We Are Online 24/7