The Dubai property market report Q4 2025 ended the year on a strong note. In Q4 2025, Dubai real estate market recorded approximately AED 140.87 bn in sales, up from around 116.5 bn from Q4 2024. Property transaction value rose by around 12% year on year. Sales stayed active across apartments, townhouses, and villas. Off-plan homes led demand and made up nearly 58% of all transactions. This shows solid buyer trust in upcoming projects.

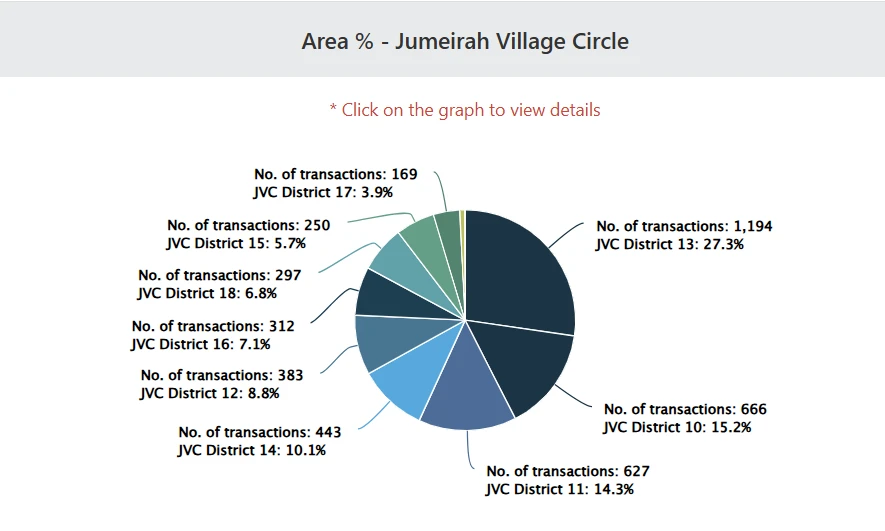

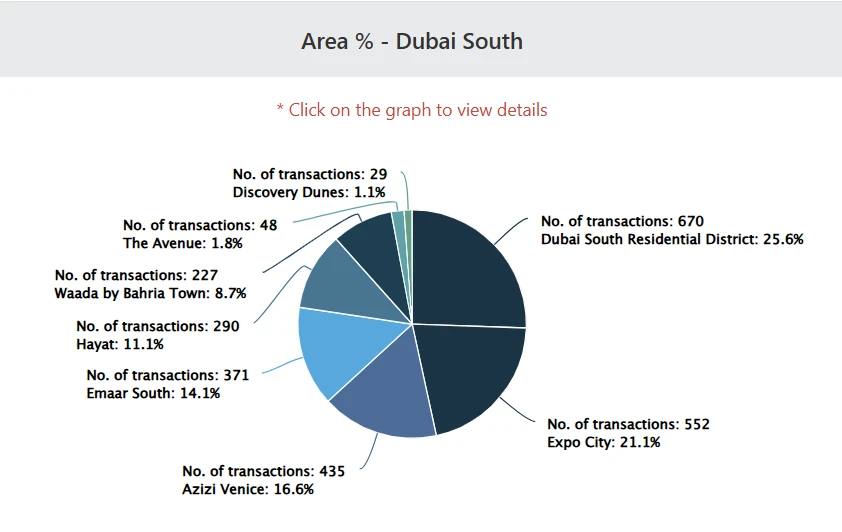

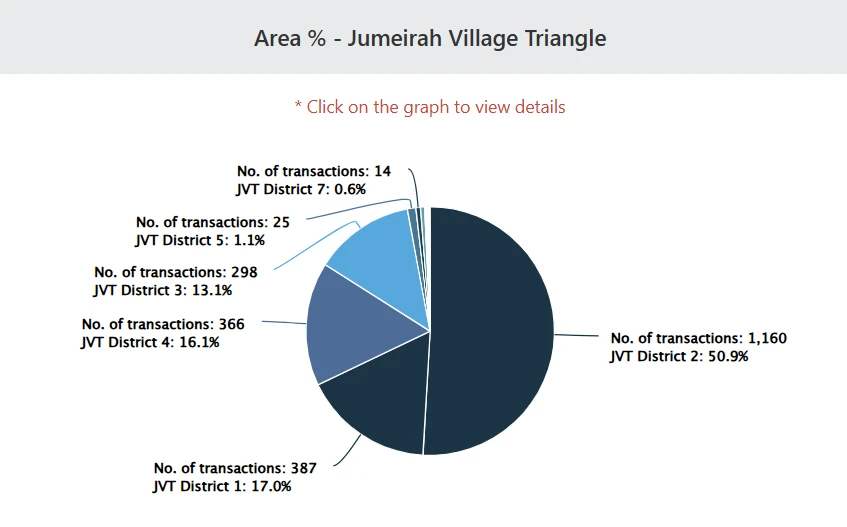

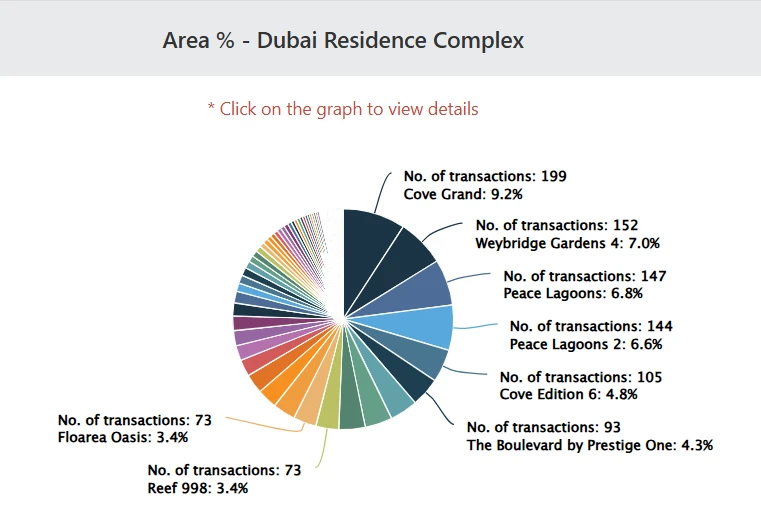

Jumeirah Village Circle and Business Bay led transactions by volume and value. JV stayed popular for mid-priced apartments, while Business Bay attracted premium apartment buyers. Dubai South followed with strong townhouse and villa demand. Jumeirah Village Triangle recorded steady apartment sales. Dubai Residence Complex remained popular for entry-level buyers due to affordable pricing

Properties for sale in JVC led Q4 activity with strong demand for studios and 1-bed apartments. Apartments dominated total transactions, supported by steady investor interest.

Bedroom Breakdown

|

Unit Type |

Total Sales Value (AED) |

Transactions |

Avg Price (AED) |

Avg Price (AED/sq ft) |

|

Studio |

988,056,598 |

1,418 |

696,796 |

1,718 |

|

1 Bed |

2,664,966,412 |

2,318 |

1,149,684 |

1,462 |

|

2 Bed |

865,848,986 |

502 |

1,724,799 |

1,295 |

|

3 Bed |

263,231,439 |

96 |

2,741,994 |

1,318 |

|

4 Bed |

102,194,000 |

30 |

3,406,467 |

1,038 |

|

5 Bed |

10,020,000 |

2 |

5,010,000 |

991 |

Property Type Breakdown

|

Property Type |

Transactions |

Total Sales Value (AED) |

Avg Price (AED) |

Avg Price (AED/sq ft) |

|

Apartment |

4,291 |

4,617,798,499 |

1,076,159 |

1,527 |

|

Townhouse |

66 |

251,311,000 |

3,807,742 |

1,052 |

|

Villa |

18 |

74,060,000 |

4,114,444 |

1,344 |

|

Overall |

4,375 |

4,943,169,499 |

1,129,867 |

1,519 |

Business Bay properties for sale recorded high-value apartment transactions in Q4. Larger units pushed average prices higher.

Bedroom Breakdown

|

Unit Type |

Total Sales Value (AED) |

Transactions |

Avg Price (AED) |

Avg Price (AED/sq ft) |

|

Studio |

969,520,623 |

816 |

1,188,138 |

2,605 |

|

1 Bed |

2,389,102,207 |

1,154 |

2,070,279 |

2,450 |

|

2 Bed |

2,291,656,008 |

640 |

3,580,713 |

2,407 |

|

3 Bed |

1,010,930,059 |

143 |

7,069,441 |

2,542 |

|

4 Bed |

295,695,548 |

25 |

11,827,822 |

2,577 |

|

5 Bed |

242,687,920 |

6 |

40,447,987 |

3,079 |

|

6 Bed |

625,100,000 |

4 |

156,275,000 |

5,629 |

Property Type Breakdown

|

Property Type |

Transactions |

Total Sales Value (AED) |

Avg Price (AED) |

Avg Price (AED/sq ft) |

|

Apartment |

2,789 |

7,828,692,365 |

2,806,989 |

2,497 |

|

Overall |

2,789 |

7,828,692,365 |

2,806,989 |

2,497 |

Dubai South showed strong family-driven demand in Q4. Townhouses and villas lifted average deal sizes, supporting steady growth in Dubai property Q4 2025.

Bedroom Breakdown

|

Unit Type |

Total Sales Value (AED) |

Transactions |

Avg Price (AED) |

Avg Price (AED/sq ft) |

|

Studio |

323,312,181 |

574 |

563,262 |

1,475 |

|

1 Bed |

937,372,466 |

756 |

1,239,911 |

1,644 |

|

2 Bed |

1,285,277,713 |

664 |

1,935,659 |

1,636 |

|

3 Bed |

586,395,888 |

196 |

2,991,816 |

1,314 |

|

4 Bed |

966,244,108 |

227 |

4,256,582 |

1,207 |

|

5 Bed |

905,190,217 |

161 |

5,622,299 |

1,198 |

|

6 Bed |

73,213,000 |

11 |

6,655,727 |

1,230 |

|

7 Bed |

91,750,000 |

4 |

22,937,500 |

1,676 |

Property Type Breakdown

|

Property Type |

Transactions |

Total Sales Value (AED) |

Avg Price (AED) |

Avg Price (AED/sq ft) |

|

Apartment |

2,058 |

2,727,551,409 |

1,325,341 |

1,591 |

|

Townhouse |

484 |

2,058,237,388 |

4,252,557 |

1,197 |

|

Villa |

80 |

557,374,709 |

6,967,184 |

1,323 |

|

Overall |

2,622 |

5,343,163,506 |

2,037,820 |

1,512 |

JVT remained active with strong studio and 1-bed apartment sales. Villas for sale in JVT recorded higher rates per sq ft.

Bedroom Breakdown

|

Unit Type |

Total Sales Value (AED) |

Transactions |

Avg Price (AED) |

Avg Price (AED/sq ft) |

|

Studio |

651,771,322 |

855 |

762,306 |

1,892 |

|

1 Bed |

1,325,056,157 |

1,067 |

1,241,852 |

1,593 |

|

2 Bed |

687,797,894 |

335 |

2,053,128 |

1,386 |

|

3 Bed |

44,749,230 |

16 |

2,796,827 |

1,382 |

|

4 Bed |

15,136,599 |

4 |

3,784,150 |

1,302 |

Property Type Breakdown

|

Property Type |

Transactions |

Total Sales Value (AED) |

Avg Price (AED) |

Avg Price (AED/sq ft) |

|

Apartment |

2,245 |

2,570,862,202 |

1,644,608 |

1,670 |

|

Villa |

24 |

137,164,000 |

5,715,167 |

2,026 |

|

Townhouse |

9 |

27,185,000 |

3,020,556 |

1,473 |

|

Overall |

2,278 |

2,735,211,202 |

1,726,704 |

1,673 |

Dubai Residence Complex remained popular among entry-level buyers. Studio and 1-bed apartments for sale in DRC drove most of the transaction activities in Q4 2025.

Bedroom Breakdown

|

Unit Type |

Total Sales Value (AED) |

Transactions |

Avg Price (AED) |

Avg Price (AED/sq ft) |

|

Studio |

720,266,144 |

1,066 |

675,672 |

1,572 |

|

1 Bed |

747,104,986 |

741 |

1,008,239 |

1,250 |

|

2 Bed |

449,121,410 |

329 |

1,365,111 |

1,118 |

|

3 Bed |

53,743,451 |

34 |

1,580,690 |

1,146 |

|

4 Bed |

4,621,660 |

2 |

2,310,830 |

1,414 |

Property Type Breakdown

|

Property Type |

Transactions |

Total Sales Value (AED) |

Avg Price (AED) |

Avg Price (AED/sq ft) |

|

Apartment |

2,172 |

1,974,857,651 |

1,519,084 |

1,386 |

|

Overall |

2,172 |

1,974,857,651 |

1,519,084 |

1,386 |

Dubai property market Q4 2025 recorded strong activity across Dubai, with total sales reaching impressive numbers driven by steady demand. Jumeirah Village Circle recorded the highest number of deals. Key areas like Dubai South, Business Bay, Jumeirah Village Triangle, and Dubai Residence Complex also posted high activity and rising values.

If you are planning to invest in Dubai real estate, contact Primo Capital today. We can guide you with clear details on area performance, pricing, unit types, and upcoming handovers. Let’s start your property journey now.

Senior Property Advisor

Mohamad Zeaiter is a distinguished Senior Property Advisor with over eight years of expertise in the real estate industr...

Feel Free to Contact Us at Any Time, We Are Online 24/7