The Dubai property market report September 2025 highlights another strong month for the city’s property sector. Sales continued to grow with 20,127 transactions recorded, marking an 11.3% rise from September 2024. The value of these sales reached AED 54.3 billion, reflecting a 21.2% increase year-on-year. Prices also inched higher, with the average price per sq. ft. standing at AED 1,689.

Apartment rents averaged AED 88,000, villas reached AED 190,000, while commercial rents hit AED 75,000, showing a 10.3% rise from September 2024.

Total Value: AED 1,318,409,784

Flats: AED 1,241,841,494 (94.2%)

Villas: AED 46,001,362 (3.5%)

Hotel Apartments & Rooms: AED 7,008,167 (0.5%)

Commercial: AED 23,558,761 (1.8%)

Total Value: AED 676,333,279

Flats: AED 367,005,631 (54.3%)

Villas: AED 141,220,166 (20.9%)

Hotel Apartments & Rooms: AED 34,701,257 (5.1%)

Commercial: AED 133,406,225 (19.7%)

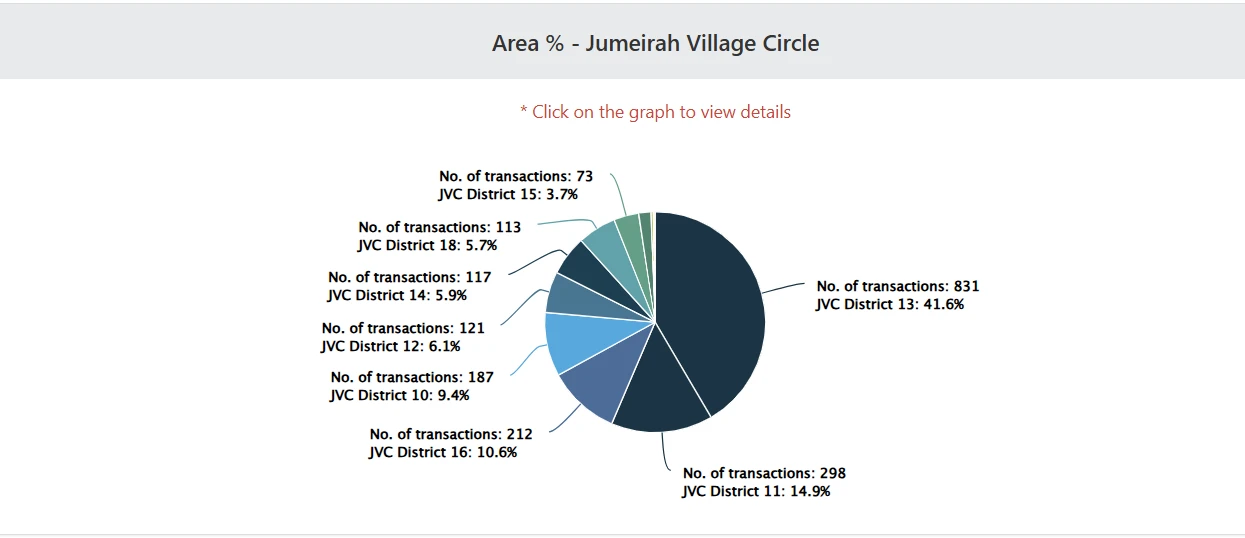

JVC kept its spot as one of the busiest hubs in Dubai real estate market September 2025, with apartments leading sales activity.

|

Type |

Total Price (AED) |

No. of Transactions |

Avg Price (AED) |

Avg Price (AED/sq. ft.) |

|

Studio |

506,648,244 |

709 |

714,596 |

1,757 |

|

1 Bed |

1,210,567,395 |

1,058 |

1,144,204 |

1,455 |

|

2 Bed |

342,519,508 |

192 |

1,783,956 |

1,342 |

|

3 Bed |

66,272,692 |

28 |

2,366,882 |

1,170 |

|

4 Bed |

39,473,000 |

11 |

3,588,455 |

1,198 |

|

Type |

Total Sales Price (AED) |

No. of Transactions |

Avg Sales Price (AED) |

Avg Price (AED/sq. ft.) |

|

Overall |

2,167,845,839 |

2,000 |

1,083,923 |

1,546 |

|

Apartment |

2,083,319,839 |

1,975 |

1,054,845 |

1,551 |

|

Townhouse |

66,777,000 |

21 |

3,179,857 |

1,053 |

|

Villa |

17,749,000 |

4 |

4,437,250 |

1,755 |

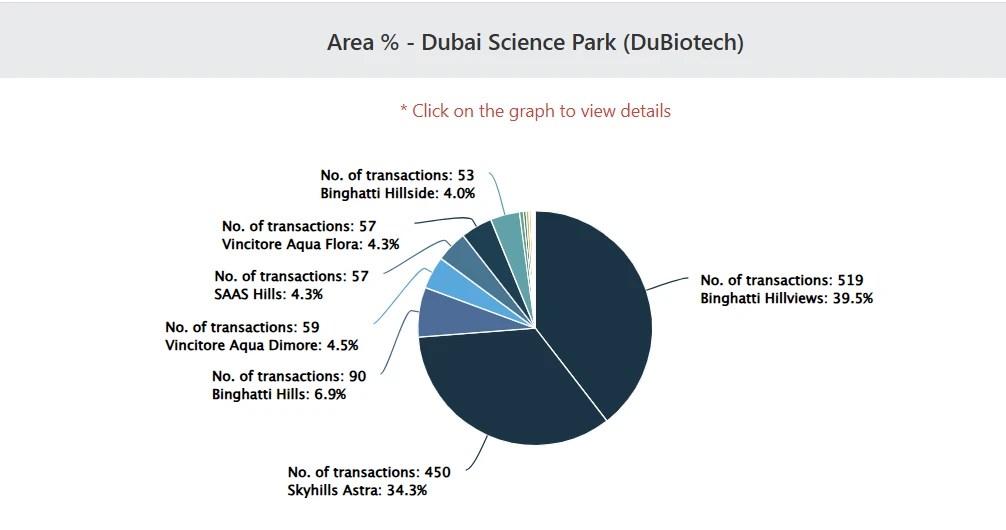

Smaller units dominated transactions here, making the area attractive for mid-range buyers.

|

Type |

Total Price (AED) |

No. of Transactions |

Avg Price (AED) |

Avg Price (AED/sq. ft.) |

|

Studio |

583,811,790 |

667 |

875,280 |

2,009 |

|

1 Bed |

732,024,402 |

531 |

1,378,577 |

1,527 |

|

2 Bed |

263,551,222 |

107 |

2,463,096 |

1,613 |

|

3 Bed |

17,957,655 |

5 |

3,591,531 |

1,455 |

|

4 Bed |

19,199,333 |

2 |

9,599,667 |

2,066 |

|

5 Bed |

11,000,000 |

1 |

11,000,000 |

1,804 |

|

Type |

Total Sales Price (AED) |

No. of Transactions |

Avg Sales Price (AED) |

Avg Price (AED/sq. ft.) |

|

Overall |

1,627,544,402 |

1,313 |

1,239,562 |

1,780 |

|

Apartment |

1,616,544,402 |

1,312 |

1,232,122 |

1,780 |

|

Villa |

11,000,000 |

1 |

11,000,000 |

1,804 |

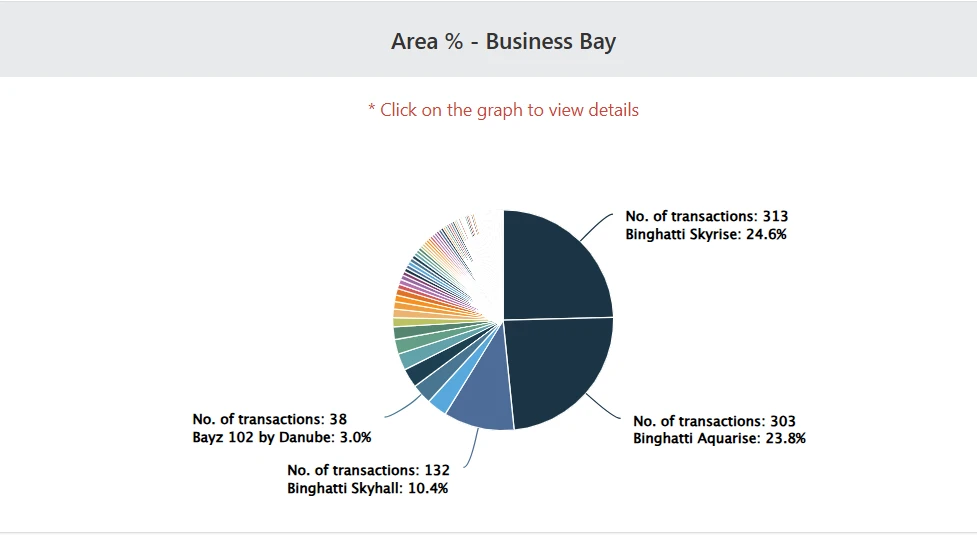

Business Bay remained a high-demand spot, with strong performance in one and two-bedroom apartments.

|

Type |

Total Price (AED) |

No. of Transactions |

Avg Price (AED) |

Avg Price (AED/sq. ft.) |

|

Studio |

755,570,411 |

600 |

1,259,284 |

2,813 |

|

1 Bed |

940,336,565 |

446 |

2,108,378 |

2,514 |

|

2 Bed |

589,412,743 |

185 |

3,186,015 |

2,379 |

|

3 Bed |

232,691,789 |

30 |

7,756,393 |

3,004 |

|

4 Bed |

160,714,731 |

11 |

14,610,430 |

3,203 |

|

Type |

Total Sales Price (AED) |

No. of Transactions |

Avg Sales Price (AED) |

Avg Price (AED/sq. ft.) |

|

Overall |

2,678,726,239 |

1,272 |

2,105,917 |

2,653 |

|

Apartment |

2,678,726,239 |

1,272 |

2,105,917 |

2,653 |

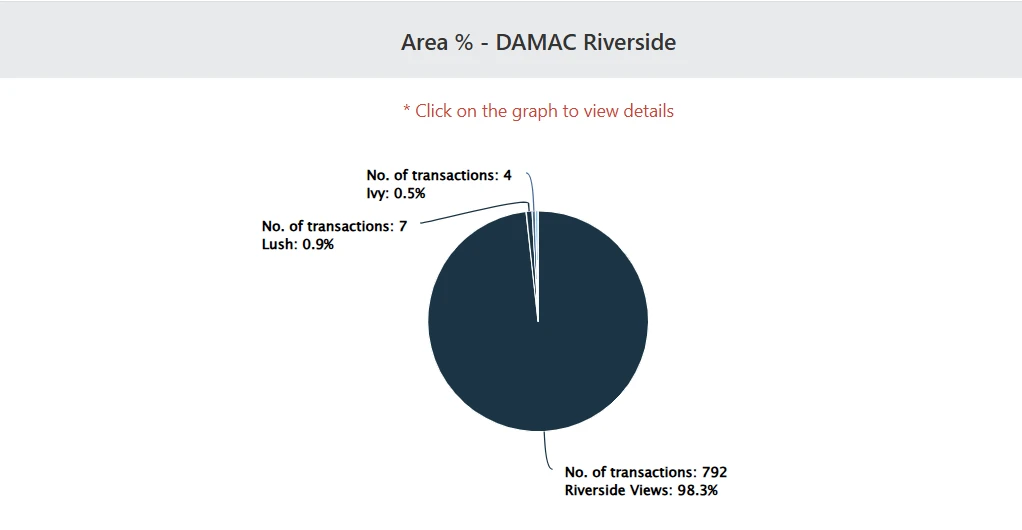

One-bedroom apartments led transactions, keeping Damac Riverside in demand for entry-level buyers.

|

Type |

Total Price (AED) |

No. of Transactions |

Avg Price (AED) |

Avg Price (AED/sq. ft.) |

|

1 Bed |

818,001,488 |

692 |

1,182,083 |

1,496 |

|

2 Bed |

185,544,640 |

100 |

1,855,446 |

1,473 |

|

4 Bed |

15,238,000 |

6 |

2,539,667 |

1,079 |

|

5 Bed |

33,693,848 |

8 |

4,211,731 |

1,231 |

|

Type |

Total Sales Price (AED) |

No. of Transactions |

Avg Sales Price (AED) |

Avg Price (AED/sq. ft.) |

|

Overall |

1,052,477,976 |

806 |

1,305,804 |

1,487 |

|

Apartment |

1,003,546,128 |

792 |

1,267,104 |

1,493 |

|

Townhouse |

48,931,848 |

14 |

3,495,132 |

1,166 |

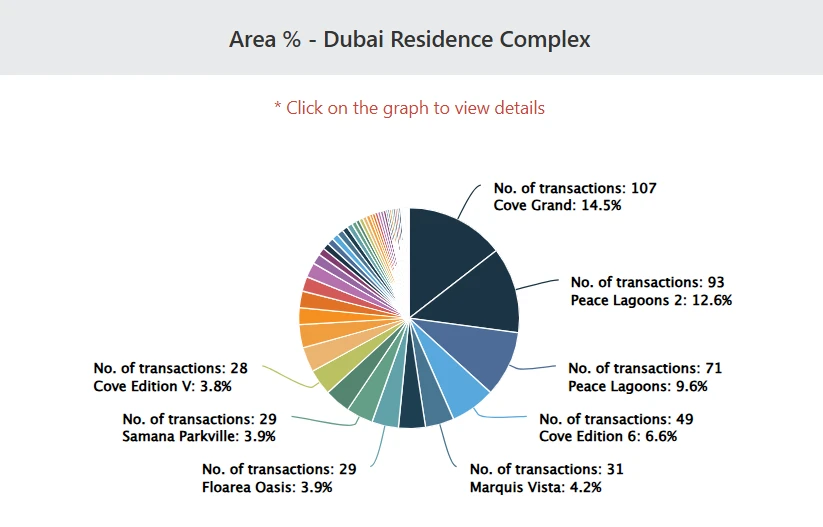

Affordable housing continued to drive sales in Dubai Residence Complex, supported by attractive price points.

|

Type |

Total Price (AED) |

No. of Transactions |

Avg Price (AED) |

Avg Price (AED/sq. ft.) |

|

Studio |

255,740,024 |

387 |

660,827 |

1,564 |

|

1 Bed |

259,024,215 |

249 |

1,040,258 |

1,297 |

|

2 Bed |

133,114,924 |

93 |

1,431,343 |

1,126 |

|

3 Bed |

13,581,091 |

8 |

1,697,636 |

1,162 |

|

Type |

Total Sales Price (AED) |

No. of Transactions |

Avg Sales Price (AED) |

Avg Price (AED/sq. ft.) |

|

Overall |

661,460,254 |

737 |

897,504 |

1,414 |

|

Apartment |

661,460,254 |

737 |

897,504 |

1,414 |

The Dubai property market report September 2025 reflects steady growth with apartments and commercial properties leading the way, while villa sales slowed down. Rental values continued their upward trend, showing strong demand across all segments. With top developers posting multi-billion-dirham sales and prime areas recording high transactions, the Dubai real estate market remains one of the strongest in the region.

Feel Free to Contact Us at Any Time, We Are Online 24/7