Buying a property in the UAE is a big financial step, and the first thing that you need to know is that you are eligible to secure a mortgage that can help you own the house of your dream. The UAE mortgage calculator will help you estimate your monthly payments, loan amount, and interest rate before you go to a bank. More importantly, it shows you how your Debt Burden Ratio (DBR) will affect your eligibility.

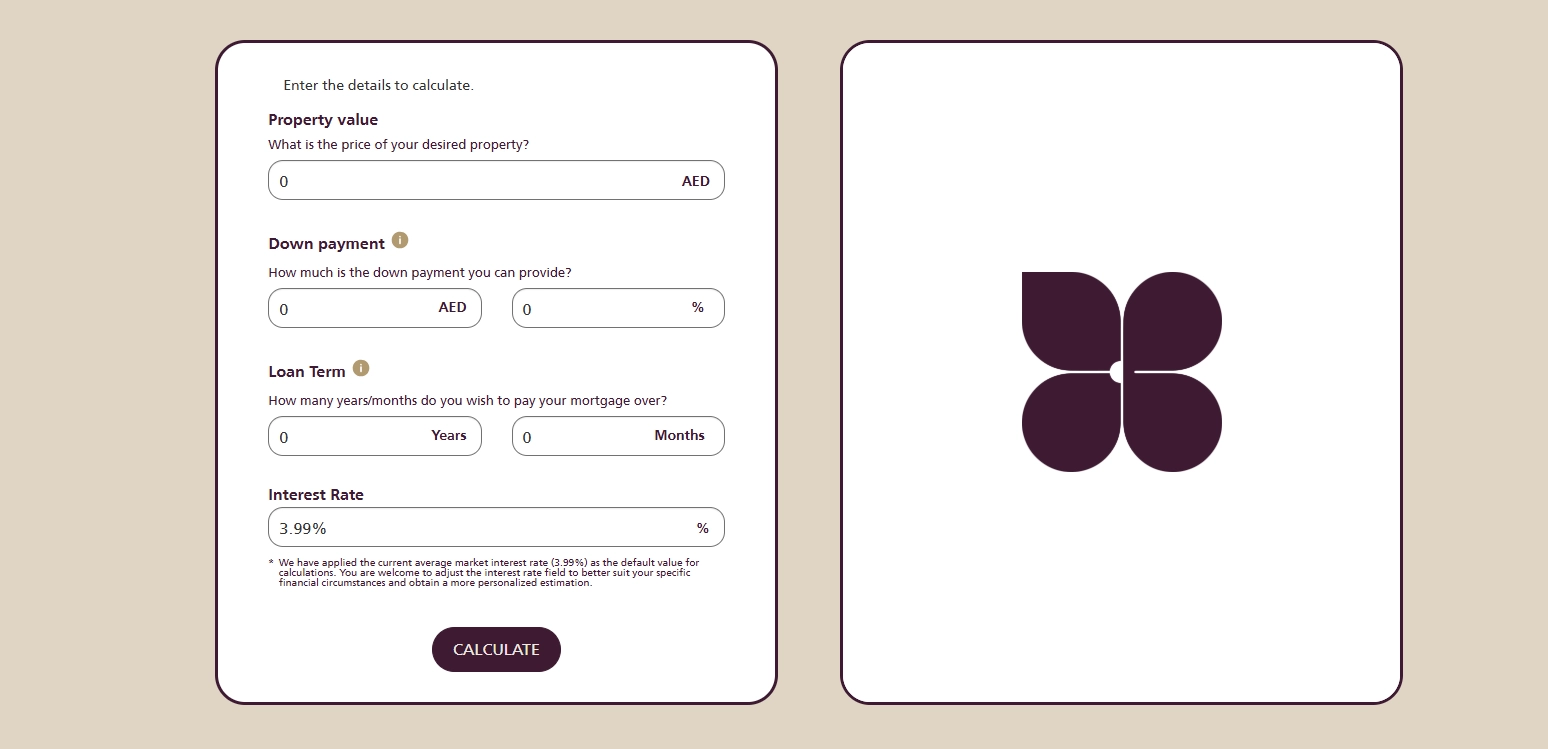

The Loans and Homes Mortgage Calculator gives you a clear, easy, quick view of what you can afford, using real market data and UAE lending regulations. Let’s have a look at the functioning of this calculator and how each field affects your eligibility for a mortgage.

A UAE mortgage calculator is an online tool that provides a rough estimate of your mortgage payment over a given period, based on a few details: property value, down payment amount, loan term, and interest rate. The UAE banks also consider affordability in terms of DBR, which helps ensure that a borrower does not incur a debt amount they can comfortably repay.

To determine your mortgage eligibility and your Debt Burden Ratio (DBR), add up all of your monthly debts (credit cards, loans—typically 5% of the limit) and divide the total by your monthly income. The result should be below the 50% limit set by the Central Bank for most loans, with lower DBRs improving loan prospects. You can also use online calculators for quick estimates. Additionally, banks consider minimum salary requirements (e.g., AED 15,000 for expats) and stress-test rates, adding 2-4% to the interest rate for affordability assessment.

Field: Property Value (AED)

This is the purchase price of the property that you want to buy.

Example:

If the property value is AED 1,000,000 and the bank finances 75%, your maximum loan would be AED 750,000.

Field: Down Payment (AED or %)

This is the amount you pay upfront from your own savings.

Minimum down payment requirements are governed in the United Arab Emirates:

The Loan Home calculator allows you to enter the down payment either as a percentage or in AED, making it flexible and easy to adjust.

Field: Loan Term (Years & Months)

This is the duration over which you will repay your mortgage.

Example:

A 25-year loan is cheaper than a 15-year loan in terms of payment, which is paid over a better and longer-term investment, but you end up paying more interest.

Field: Interest Rate (%)

This is the annual rate charged by the bank on your mortgage.

The Home Loan eligibility calculator UAE uses a default market rate (e.g., 3.99%), which reflects current UAE mortgage trends. You can adjust this rate to match:

Why it matters:

DBR is one of the most important factors in the mortgage eligibility calculator UAE approval.

DBR is the percentage of your monthly income used to pay debts, including:

UAE Central Bank Rule:

Your total DBR must not exceed 50% of your monthly income.

Example:

If your monthly salary is AED 20,000, your total debt payments cannot exceed AED 10,000.

How the calculator helps:

The Home Loan eligibility calculator is built to reflect real UAE banking criteria, making it more than just a basic EMI tool.

Key benefits:

It is ideal for:

Understanding and using mortgage eligibility is not rocket science. With the assistance of the Loans & Homes UAE Mortgage Calculator, you can check how property value, down payment, loan term, and interest rate impact the monthly payments and debt burden ratio.

This clarity can help you make smarter choices, avoid over-borrowing, and even approach banks. It is the best place to begin, whether you are first-time home buyers or property investors, with a mortgage calculator.

Feel Free to Contact Us at Any Time, We Are Online 24/7