The Dubai proprty market report October 2025 shows steady growth driven by strong investor confidence and consistent demand in residential and commercial segments. Backed by new infrastructure projects and rising foreign investments, properties for sale in Dubai maintained stable momentum across all sectors.

During Q3 2025, property transactions increased in both value and volume. Residential sales led the activity, while hospitality and commercial spaces stayed in demand thanks to a thriving business and tourism environment. Meanwhile, home insurance premiums rose by 9%, reflecting higher property ownership.

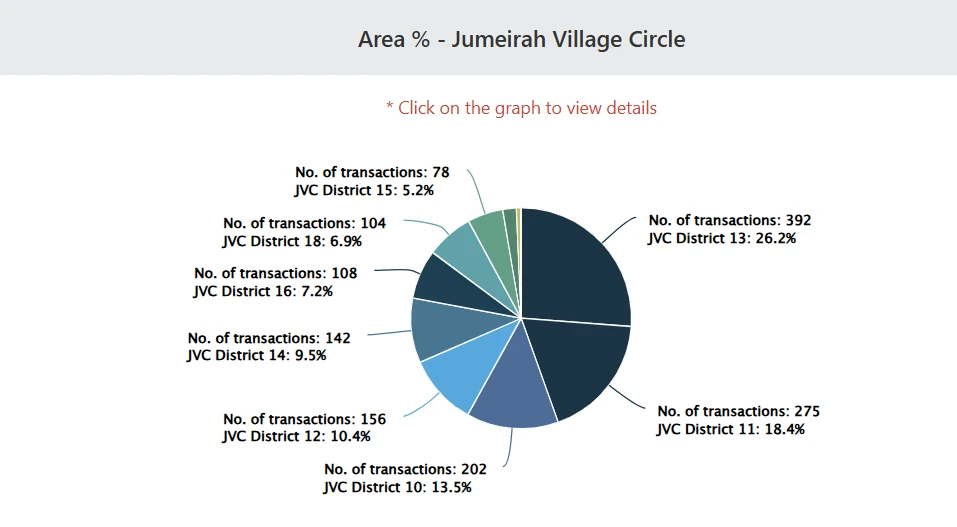

Jumeirah Village Circle (JVC) continued to be a top-performing area, driven by its affordable apartments and mid-range townhouses attracting both investors and end-users.

Sales by Bedroom Type

|

Type |

Total Price (AED) |

No. of Transactions |

Average Price (AED) |

Average Price (AED/sq ft) |

|

Studio |

343,327,385 |

505 |

679,856 |

1,682 |

|

1 Bed |

862,506,380 |

767 |

1,124,519 |

1,443 |

|

2 Bed |

296,567,946 |

170 |

1,744,517 |

1,307 |

|

3 Bed |

100,293,722 |

37 |

2,710,641 |

1,216 |

|

4 Bed |

50,670,000 |

14 |

3,619,286 |

1,032 |

Sales by Property Type

|

Type |

Total Sales Price (AED) |

No. of Transactions |

Average Price (AED) |

Average Price (AED/sq ft) |

|

Apartment |

1,537,539,883 |

1,462 |

1,077,029 |

1,507 |

|

Townhouse |

125,787,000 |

26 |

4,837,962 |

1,056 |

|

Villa |

33,535,000 |

9 |

3,726,111 |

1,246 |

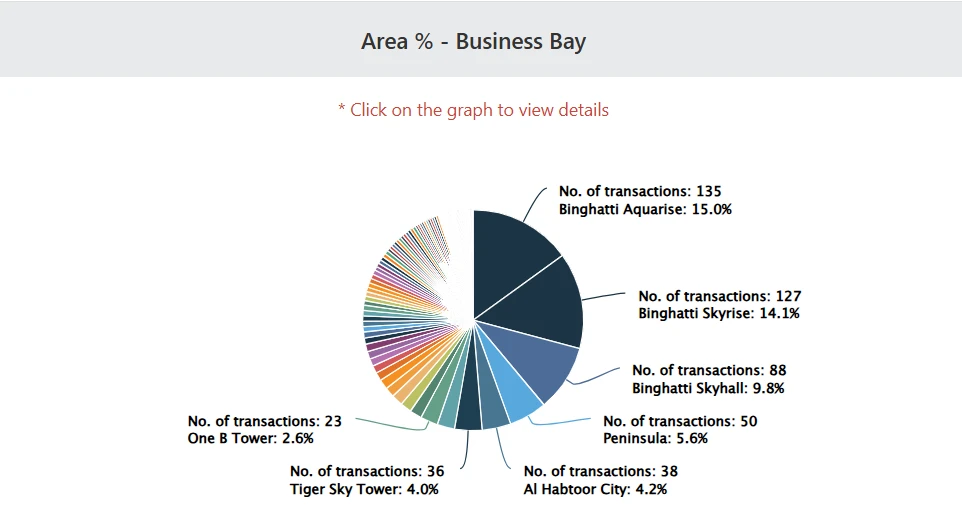

Business Bay’s property market performance remained strong, supported by high investor demand for premium apartments and a consistent rental market.

Sales by Bedroom Type

|

Type |

Total Price (AED) |

No. of Transactions |

Average Price (AED) |

Average Price (AED/sq ft) |

|

Studio |

315,888,155 |

274 |

1,152,876 |

2,550 |

|

1 Bed |

765,851,061 |

382 |

2,004,846 |

2,379 |

|

2 Bed |

649,428,444 |

182 |

3,568,288 |

2,351 |

|

3 Bed |

396,242,809 |

45 |

8,805,396 |

2,661 |

|

4 Bed |

151,493,808 |

10 |

15,149,381 |

2,631 |

|

5 Bed |

214,888,260 |

5 |

42,977,652 |

2,880 |

Sales by Property Type

|

Type |

Total Sales Price (AED) |

No. of Transactions |

Average Price (AED) |

Average Price (AED/sq ft) |

|

Apartment |

2,497,792,537 |

899 |

2,778,412 |

2,444 |

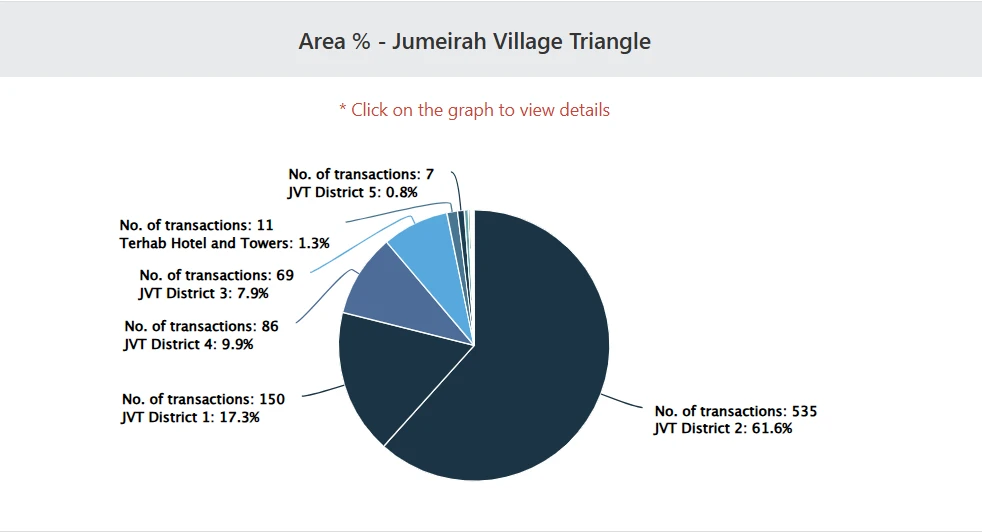

Jumeirah Village Triangle (JVT) saw stable sales in October, particularly in 1 and 2-bedroom apartments, reflecting steady end-user and investor interest.

Sales by Bedroom Type

|

Type |

Total Price (AED) |

No. of Transactions |

Average Price (AED) |

Average Price (AED/sq ft) |

|

Studio |

270,842,385 |

349 |

776,053 |

1,915 |

|

1 Bed |

497,257,417 |

398 |

1,249,390 |

1,579 |

|

2 Bed |

244,693,663 |

115 |

2,127,771 |

1,359 |

|

3 Bed |

17,799,995 |

6 |

2,966,666 |

1,368 |

Sales by Property Type

|

Type |

Total Sales Price (AED) |

No. of Transactions |

Average Price (AED) |

Average Price (AED/sq ft) |

|

Apartment |

973,898,460 |

856 |

1,137,732 |

1,680 |

|

Villa |

45,015,000 |

8 |

5,626,875 |

2,092 |

|

Townhouse |

11,680,000 |

4 |

2,920,000 |

1,522 |

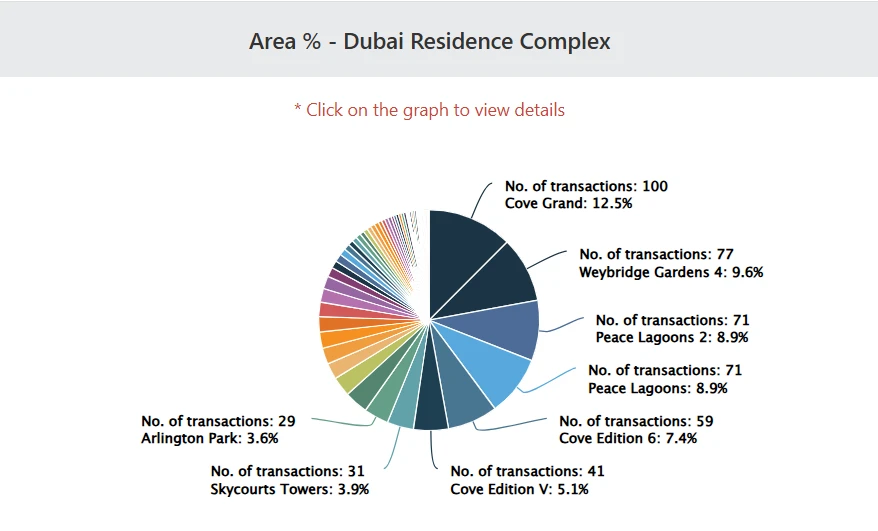

Dubai Residence Complex recorded strong sales among studios and 1-bedroom apartments, driven by affordable pricing and rental yield potential.

Sales by Bedroom Type

|

Type |

Total Price (AED) |

No. of Transactions |

Average Price (AED) |

Average Price (AED/sq ft) |

|

Studio |

297,983,234 |

434 |

686,597 |

1,611 |

|

1 Bed |

261,082,445 |

257 |

1,015,885 |

1,247 |

|

2 Bed |

125,377,150 |

92 |

1,362,795 |

1,113 |

|

3 Bed |

26,959,723 |

16 |

1,684,983 |

1,171 |

|

4 Bed |

4,621,660 |

2 |

2,310,830 |

1,414 |

Sales by Property Type

|

Type |

Total Sales Price (AED) |

No. of Transactions |

Average Price (AED) |

Average Price (AED/sq ft) |

|

Apartment |

716,024,212 |

801 |

893,913 |

1,428 |

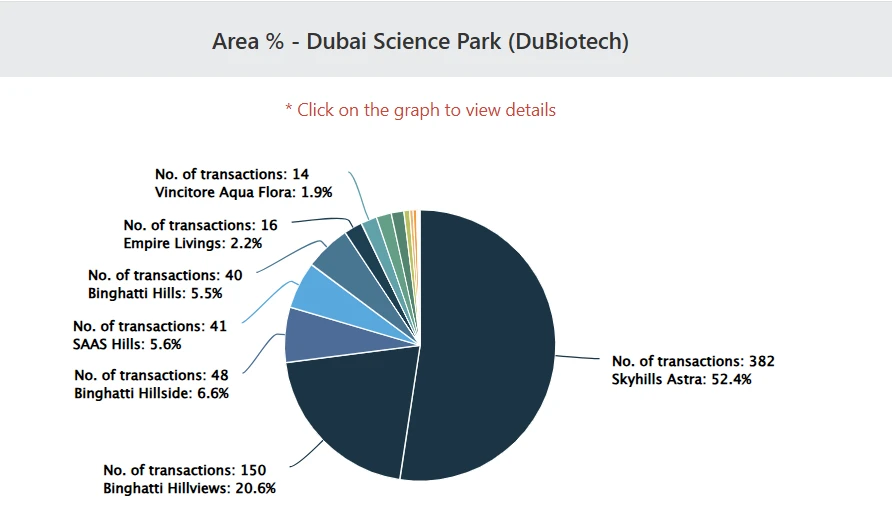

Dubai Science Park experienced growing traction in mid-range apartment sales, especially in studios and 1-bed units, reflecting strong rental demand from professionals.

Sales by Bedroom Type

|

Type |

Total Price (AED) |

No. of Transactions |

Average Price (AED) |

Average Price (AED/sq ft) |

|

Studio |

323,768,057 |

366 |

884,612 |

2,022 |

|

1 Bed |

459,064,477 |

315 |

1,457,348 |

1,542 |

|

2 Bed |

87,867,414 |

37 |

2,374,795 |

1,385 |

|

3 Bed |

32,983,836 |

9 |

3,664,871 |

1,407 |

|

4 Bed |

17,234,553 |

2 |

8,617,277 |

1,936 |

Sales by Property Type

|

Type |

Total Sales Price (AED) |

No. of Transactions |

Average Price (AED) |

Average Price (AED/sq ft) |

|

Apartment |

914,918,337 |

728 |

1,256,756 |

1,774 |

|

Villa |

6,000,000 |

1 |

6,000,000 |

1,983 |

The Dubai property market October 2025 reflects sustained growth, strong investor confidence, and rising property values across key areas. With off-plan projects driving major sales and stable demand across residential and commercial sectors, Dubai continues to stand out as a preferred market for global investors. For those planning to buy properties in Dubai, get in touch with Primo Capital today to find the best investment opportunities across the city’s top-performing communities.

Property Advisor

Cornelia Broman brings 3 years of real estate experience, supporting clients across Dubai’s residential and off-pl...

Feel Free to Contact Us at Any Time, We Are Online 24/7